Private Lending Notes & JV Partners

Investing in real estate with us isn’t limited to long-term buy-and-holds. If you’re looking to diversify your portfolio a bit more and add some short-term returns, then Private Lending is the next pitstop on your road to financial freedom (and you can do it over and over again). Real Estate is a tried-and-true vehicle for investing and great returns, but there are right ways to do it, and wrong ways to do it. Fortunately for you, we’ve already taken the liberty of attempting most of the wrong ways to do it since 2004, and have eliminated those methods from our roster, saving you a ton of time and headaches.

Over the course of nearly 3000 transactions, we’ve learned exactly how to make the most of the real estate market in our own backyard. We were around for the last great crash in 2007-2008, so we know firsthand how to navigate all kinds of economic landscapes.

Whether you’re new to investing with us, or you’ve purchased rental investment properties from us in the past, and you’re interested in expanding a little further – reach out and ask about our Private Lending options via the form below, and in the meantime, we’ll do our best to pre-emptively answer some questions you might have about us and our private lending investment options:

Private Lending

A faster way to earn your returns!

What experience does Ohio Turnkey have?

Over the past 18 years, we’ve tucked a lot of experiences under our belts. We’ve bought and sold a wide variety of single family homes, small multifamily homes, large multifamily homes, apartment complexes, commercial/office spaces, and occasionally a vacant lot here and there.

Most of these properties have involved some level of renovations, which we’ve performed ourselves. The founder and Owner of the company, Bryan, is a Licensed General Contractor in multiple states. Tony, our Director of Acquisitions, is also a Licensed General Contractor. They know how to walk into a house and see its full potential from all angles. This translates into solid returns for any investor who works with us, as we maximize and leverage each property we purchase to provide the best results for everyone involved.

We have worked with investors from all over the globe, and while that is certainly worth mentioning, it is perhaps MORE telling that we work with quite a few local investors as well. After all, anyone can CLAIM to be anything that they want, and splash that all over the internet, and ultimately swindle hard-working folks investing from out-of-state who have no real clue of what’s happening on the ground. It speaks volumes when locals choose to work with you, because they’re right next door, and can check in on any project at any time. When they’ve done that and see for themselves that what you are telling them is what they are getting, the level of trust and respect goes way up.

Why are you working with private lenders in the first place?

When we’re buying and selling 10-25 properties each month (*read more about our volume below), we’re quickly processing a lot of funding IN and a lot of funding OUT. This is where you come into the picture, via the opportunity to take advantage of our investment options.

What risks are involved?

Life, in general, is largely unpredictable. Even the best-laid plans of mice and men and all that – and the economy can seem just as volatile and fickle. The housing market plays a large role in the overall health of the entire country, and it is an essential and necessary corner in the foundation of every residential neighborhood. It is subject to the rise and fall of inflation, but it is also a REAL, tangible asset that will always hold value, unlike some other investing methods.

Most of the real risks when investing in any kind of real estate come from the potential for loss via property damages. Fortunately, home insurance exists, and we always have active policies on ALL of our properties. Aside from that, there is the risk, as with any type of loan, that the loan won’t be repaid in full. We’ve got that covered for you, too. When you lend to us, you have the first and only lien on a property, just like a mortgage at a bank. These are just safety nets to ease your mind, of course – we’ve never taken a loan, especially from an investor, that we haven’t repaid in full with interest (income!) on top.

What kind of properties do you invest in?

We purchase mostly A and B Class single family and multifamily homes. Over time, and through a lot of trial and error (we made all the investing mistakes already so you don’t have to!), we discovered that the best long-term real estate investment strategy was through quality properties in nice neighborhoods.

The majority of the population wants to live in a nice house in a safe area – somewhere that their kids can play in the yard, and that they can go jogging down the street at any hour, without being bothered or at a high risk of any kind of danger to their health and safety. Homes with yards and other houses for neighbors, rather than abandoned commercial spaces. Therefore, these are the types of homes we invest in ourselves.

Single family homes in these neighborhoods can range in value from $120,000 to $450,000. Small multifamily homes, such as duplexes or quadplexes, can range in value from $175,000 to $350,000. Large multifamily properties (which covers anything from 5 units to 100 units or more) obviously span the largest range, seeing values from $350,000 to $5MM+. We invest in ALL of these routinely, offering investors a variety of options and investment tiers when they choose to work with us and fund our homes.

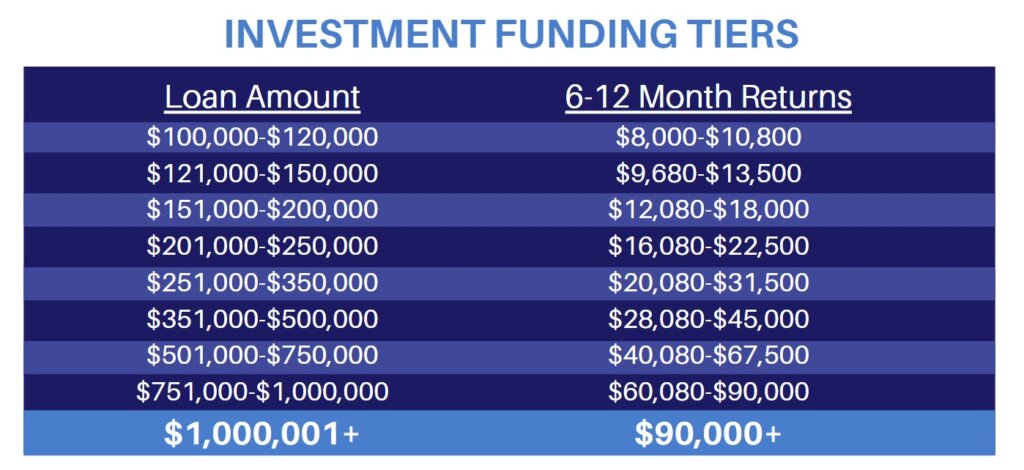

We DO NOT invest in properties that don’t fit our model. We do not buy properties that we aren’t confident in; we have to be comfortable with holding each property in our own portfolio for years, or we simply won’t buy it and take the unnecessary risk. You won’t find any opportunities to invest $50,000 towards a 12-unit property on the wrong side of the tracks with us. You will only find opportunities to invest in quality homes, and our minimum investing tier starts at $100,000, because – let’s face it – you get what you pay for in this life, and if you want something worth any real value, you have to put your money where your mouth is.

How much volume does Ohio Turnkey do?

Our team routinely closes anywhere from 10-25 properties each month, and we’ve kept that pace and volume up for many years now. The main reason that this number varies is due to the types of properties we are buying – in other words, one month we may buy 25 single family homes, but if we purchase a 24-unit apartment complex the following month, we’re more likely to purchase a lower number of single family homes that second month, say, 10 of them (we purchased 25 properties the first month for a total of 25 units, but purchased 11 properties the second month for a total of 34 units).

Overall, we aim to close between 20 and 25 properties on any given month, regardless of season. We maintain our property pipeline year-round, giving you the opportunity to work with us and put your money to work at any time.

What returns can I expect?

Private Lending Investment Options with Ohio Turnkey provide you with a guaranteed return based on an interest rate of 8-9%. This is achieved through a 6-12 month note on a specific property. Depending on how much liquid funding you wish to invest, you can passively earn from (the low end) tens of thousands of dollars, to upwards of hundreds of thousands of dollars (the high end), all in less than 12 months’ time. Occasionally, we may offer extended note options up to 18 months.

Can I invest with my IRA or 401k?

In the case of self-directed accounts, absolutely! It’s pretty simple and straightforward to utilize and deploy any funds you have sitting in one of these types of accounts to provide short-term loans to us. You get returns that are tangible – real money on a real return that’s parked in your account, that cannot just vanish into thin air (you may have experienced this type of loss if you’ve invested in stocks in the past). Let’s not forget the added bonus of tax deferral on any of those returns, too!

How does it work?

First, you speak to us and let us know what you’d like to accomplish by investing with us. We’ll need to know your timeline, available funds to deploy, and your investing goals. From there, we match you up with the right properties, and get all the documentation for the transaction drawn up with our Attorney and a reputable Title Company. If you need a remote Notary, one will be arranged at your convenience. We’ll sign the paperwork, you (or your Custodian as applicable) will wire the funds to the Title Company, and the Note will be recorded with the County. You’ll have first and only lien rights on the property.

At the end of the term of the Note, you’ll receive your initial investment back into your account, plus the interest you’ve accrued on it. A release will be signed and recorded to show that the transaction has been completed, and you’ve received the total balance due to you. You’re welcome to turn around and re-invest the original (and additional) funds with us as soon as that’s done.